Online lending has changed the borrowing landscape, making it easier than ever for customers to secure loans quickly, often within minutes. This convenience is particularly valuable for underbanked or unbanked markets, offering financial opportunities to individuals who more traditional lenders might have overlooked.

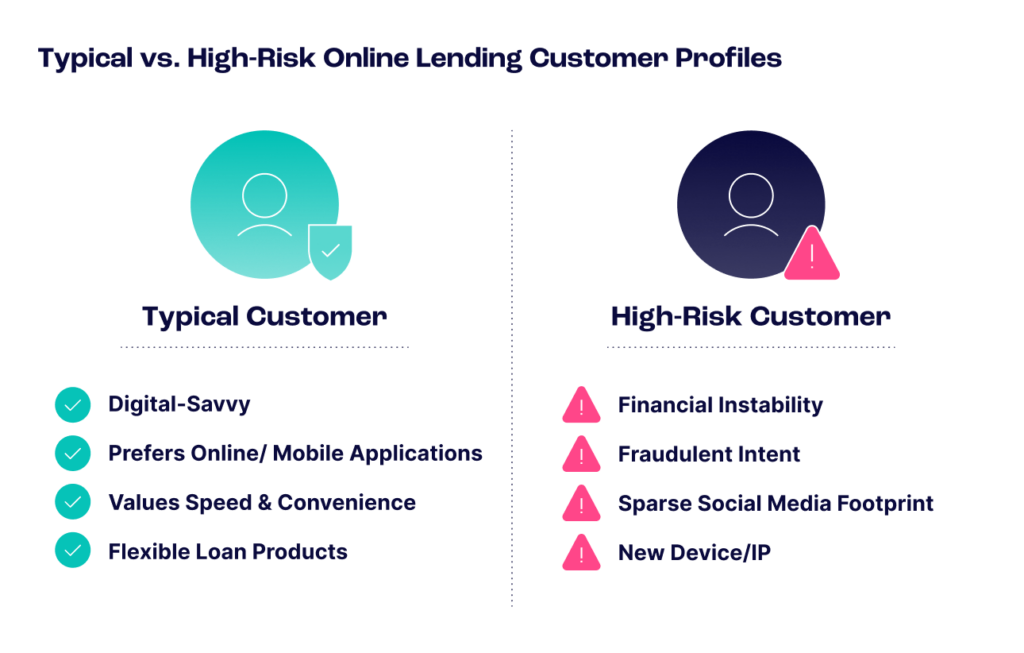

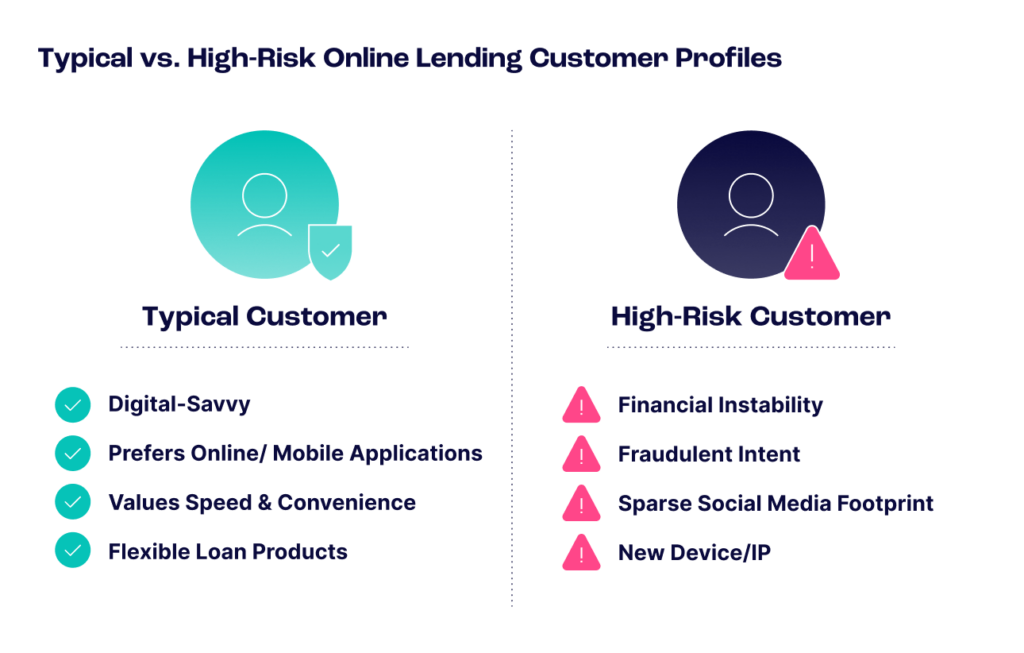

However, today’s rapid and frictionless services can also introduce new challenges in identifying and managing high-risk customers. Discerning between trustworthy borrowers and those who pose default risks is crucial for lenders. In most cases, high-risk customers can be broadly categorized into two groups: those with financial instability who might default on their loans and fraudulent actors with no intention of repaying. Both types can result in substantial financial losses and operational burdens for lenders. To service current customers to the maximum of their capabilities and expand into emerging markets without compromising their financial health, online lenders must better understand high-risk customers.

High-risk customers, whether they are financially unstable or fraudulent, can create significant challenges for online lenders, including:

Fintech provider Solventa cut fraudulent transactions by 25% and boosted the accuracy of its risk modeling by 15% with SEON’s machine learning.

Read case study

Today, the typical online lending customer is digital-savvy and values speed and convenience. They prefer applying for loans online or via mobile devices rather than in person at a bank branch, a trend especially prominent among younger borrowers. While existing relationships with banks remain essential, many customers are open to using newer fintech lenders that offer quick end-to-end processes, seamless and frictionless application processes and deliver faster loan decisions.

Online lending customers value flexible loan products and terms, competitive interest rates, transparent communications about loan terms, and status updates. This user profile reflects a growing trend toward digitization in both consumer and micro-lending practices, with customers expecting efficient and technologically advanced services from their lenders.

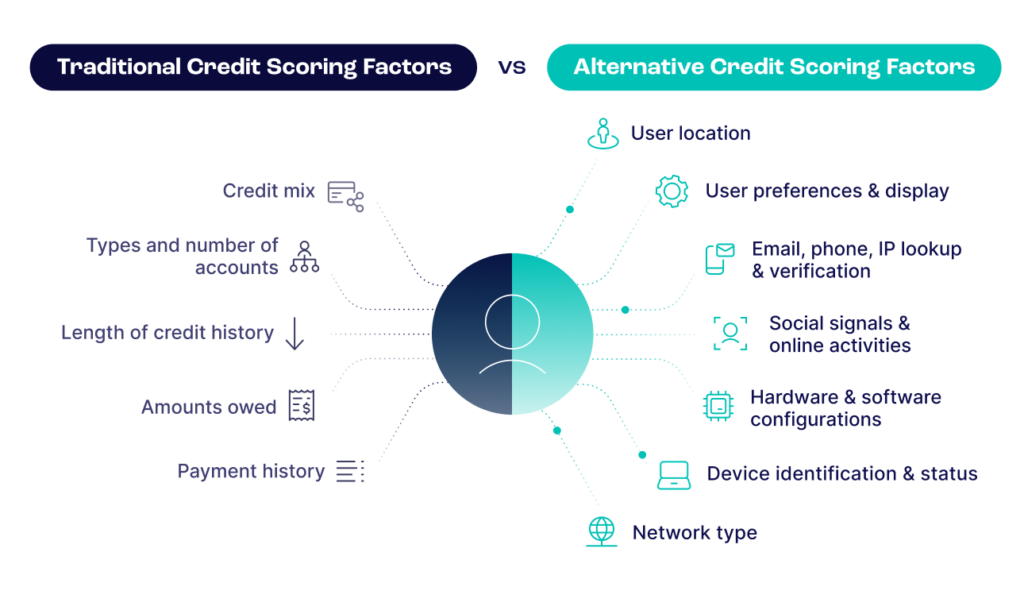

Traditional credit data can be inadequate in evaluating financial trustworthiness due to a reliance on historical data, which may not reflect current economic circumstances or other factors like job loss. Plus, online lending customers often come from underbanked markets and have limited credit histories for conventional loans. To establish better insights into creditworthiness, alternative data sources can provide a comprehensive overview of a person to understand alternative markers of economic stability – while building in a crucial layer of fraud prevention that detects deceitful or fraudulent applicants.

A typical borrower interested in a loan from an online lender usually has multiple online accounts, each sending a unique digital signal. The most common accounts include those from platforms like Amazon, Google, Facebook, Microsoft and WhatsApp. A significant drop in these signals, with fewer than six to seven social profiles or fewer – may indicate that the applicant is using a fake or stolen identity, posing a potential fraud risk.

Examining a person’s digital footprint, the trail of data they leave behind through their online activities can be analyzed to detect patterns indicative of fraudulent behavior. For instance, a Spotify account demonstrates regular monthly payments, suggesting financial consistency, while owning Apple’s premium products could indicate higher income brackets. By identifying signals from these accounts, lenders can cater their business to individuals with lower default risk scores based on valuable insights into their ability to repay debt.

As digital loan applications become more prevalent, lenders are employing sophisticated techniques to detect potential lending risks as early as possible, including those that fall into the risk of default and fraudulent intent categories. For a comprehensive understanding of a customer, online lenders need to be able to understand several key things:

With SEON, online lenders can configure rules that match risk appetite, markets, and customer information.

To filter out high-risk customers, the top three rules we see across our customer base include:

Fraudsters often try to deceive lenders by creating or acquiring legitimate identities. One tactic involves developing a digital footprint roughly matching the falsified identity, often by spoofing an IP location near the fake address or using a nearby data center. Device hashes, unique to each device, help identify such fraud attempts. When multiple accounts appear to use the same device hash but have different geolocations, it raises a red flag. This discrepancy should be manually reviewed or trigger a higher risk score, as it indicates coordinated fraudulent loan applications from a single device. By detecting this pattern, lenders can prevent synthetic ID fraud and protect against financial losses.

Creating a believable fake profile is time-consuming and resource-intensive for fraudsters, especially those looking to scale their operations. A common indicator of a fraudulent profile is a sparse social media presence combined with free phone numbers. To pass initial checks, fraudsters may set up a minimal social media footprint, often limited to one platform like LinkedIn. However, a legitimate borrower typically has a more prosperous online presence. SEON’s custom rules can detect anomalies by scanning for social media signals representing default risk. For example, an email address associated only with a LinkedIn account and lacking other social media connections suggests a potential fraudster. By flagging such profiles, lenders can focus their resources on verifying genuine applicants.

A sudden change in a customer’s device or IP address can indicate an account takeover. While there can be legitimate reasons for these changes, such as traveling with a new phone, they warrant further investigation. SEON’s custom rules can be configured to detect these scenarios by monitoring for new device hashes and IP addresses linked to existing accounts. This helps identify potential account takeovers (ATOs) early. By setting rules that raise alerts for these changes, lenders can protect their customers and their interests from unauthorized access and fraudulent loan applications.

While online lenders strive to democratize access to credit with low-friction loans, SEON aims to democratize the fight against fraud. SEON enables lenders to focus on growth and customer service without compromising security by providing tools that detect and prevent fraudulent activities.

Reduce Fraud Rates by 70–90%Partner with SEON to reduce fraud rates in your business with real-time data enrichment, machine learning, and advanced APIs.